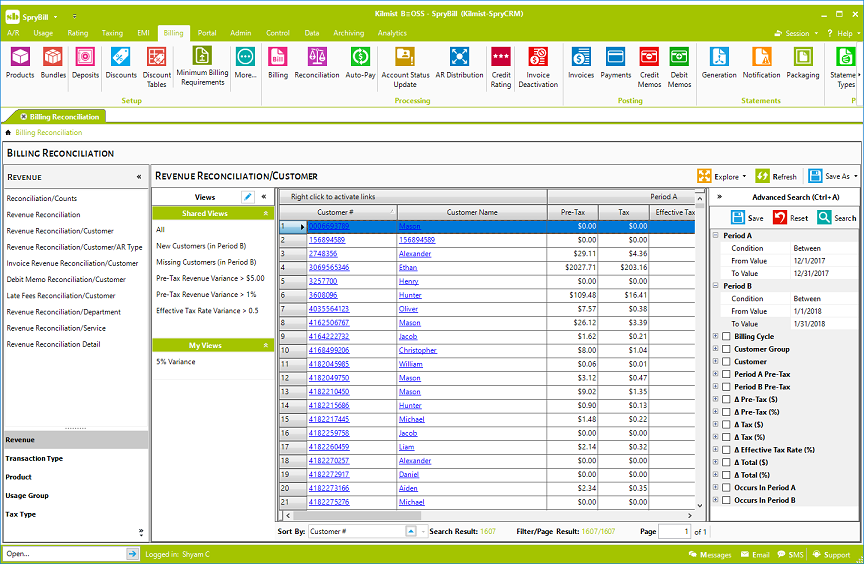

Subscription Accounting

Credits & Refunds

Apply credits and refunds to customer accounts with the capability to be as specific as you need. Specify the customer account, or select a specific invoice or even dig down to a specific invoice line item or late fee and credit/refund it. You can credit specific usage records (calls) as well.

Taxes on Credits

You have complete control over how taxes are handled in regards to credits. Apply credit to transaction amount and leave taxes untouched. Credit specific taxes (when taxes were applied in error) and leave the transaction amount untouched. Or have the system automatically compute tax credits based on the line items to which the credit was applied. We got you covered regardless of how you would like the taxes handled when applying credits.

Credit Authorization

Have tight controls on credits by creating roles that allow only authorized the users to create credit memos. SpryBill allows you to further specify limits on maximum credit that a user can create and post. You can also control who is authorized to create new credit memo reasons using roles.

Debit Memos

Make ad-hoc adjustments to customer account by issuing debit memos. Clearly track the necessity for the adjustments with detailed descriptions. Transfer all adjustments in billing smoothly to your accounting system by assigning GL account numbers. You can even split and siphon a single debit memo into multiple GL accounts.

Late Fees

Create and apply late fees to customer accounts automatically as part of recurring billing. Compute fixed late fee or a percentage of overdue amount. Setup tiered late fees, based on the amount due, to discourage your high balance customers from missing their payments. Setup rules to apply grace period, whether to calculate late fee on late fee and when to skip or waive late fees.

Minimum Billing

Ensure accounts are billed at least the minimum account to stay profitable. Establish complex minimum billing requirements on customer accounts. Apply minimum billing using a variety of rules in selecting the revenue streams – by line of business and by revenue type (product/service revenue, usage revenue or all revenue).

Credit Rating

Track your customers’ credit scores and make informed decisions based on credit data. Attain

a healthier bottom line by assessing and avoiding credit risks.

External Score –

You can import external credit scores from prominent credit bureaus – Equifax, Experian, and

TransUnion and assign custom credit ratings to your customer accounts.

Internal Credit Rating – You can leverage SpryBill’s rules based internal credit rating

engine that uses customers’ financial history within the billing system, to assign an internal

credit rating. Data readily available within the billing system can be utilized to assign a

credit rating (e.g., paid on time, paid in full, paid in installments, paid early, and monthly

revenue from the customer account). You can even work in the external credit score to play a

role in internal credit rating assignment.

Sync to Accounting System

Synchronize financial transaction data to your accounting system. Export transaction data by GL account codes in a format that facilitates easy import into your accounting system. We have built-in export plug-ins for popular accounting systems such as QuickBooks and Peachtree accounting.